Once famed for his precise bets on memecoins, on-chain whale James Wynn has recently returned to the spotlight of the crypto trading world. This time, it’s for turning a bold high-leverage trading strategy on the decentralized exchange Hyperliquid into tens of millions in profits.

So, who exactly is James Wynn? Is he a self-made investor or a stealthy capital operator? A high-stakes gambler or a financial tactician?

The Mystery of James Wynn: Who Is He Really?

Wynn’s identity and early background remain largely a mystery. There is little public information available online, and most of the industry has come to know him through his wallet addresses and on-chain transactions. He first gained widespread attention for his accurate memecoin picks, particularly with his investment in PEPE, which generated astronomical returns.

A Track Record of Spectacular Gains in Crypto

The PEPE Windfall (2023):

In 2023, Wynn entered the PEPE market with around $7,000, and through sharp market intuition and high-frequency trading, he multiplied this into approximately $25 million in a short span. This legendary trade cemented his status within the crypto community.

Diversification & Continued Activity (2023–2024):

Wynn didn’t stop at PEPE. Over the next year, he capitalized on various memecoins and trending tokens, consistently profiting through smart positioning and fast arbitrage, showing a strong sensitivity to market sentiment and price volatility.

High-Leverage Comeback on Hyperliquid (2025):

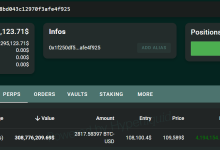

In 2025, Wynn made headlines again by executing high-leverage trades on Hyperliquid. Through bold positions on BTC, PEPE, TRUMP, and others, he reportedly generated nearly $50 million in profits over just a few months.

Aggression Meets Precision: James Wynn’s Trading Strategy

Wynn stands out for his highly aggressive yet methodical trading style. Unlike traditional investors, he thrives on volatile market sentiment, combining this with leverage tools to maximize returns while maintaining tight risk control.

- High-Leverage Tactics: Frequently uses leverage of 10x or higher to magnify position sizes and returns, showing a strong tolerance for risk in pursuit of outsized gains.

- Spot-On Market Timing: Exhibits sharp instincts for identifying the breakout points and pullbacks of trending tokens, entering and exiting with precision.

- Fast-Paced Short-Term Trades: Prefers quick trades to lock in profits and avoid the risks of long-term holding, often executing high-frequency moves.

- Emotion & Hype Radar: Monitors social media and community forums closely to ride meme-driven waves early and profit from crowd-driven price surges.

- Disciplined Risk Control: Despite his boldness, Wynn applies strict stop-loss and exit strategies, limiting downside and securing profits efficiently.

Do Retail Traders Profit by Following James Wynn?

As a whale with significant capital and visibility, Wynn’s trades often trigger FOMO (Fear of Missing Out) across the market. Take his 2023 PEPE play: He entered when the token traded at a mere $0.00000001, and it rocketed to $0.000035, a staggering 3,500x increase.

The spike drew in massive retail attention, pushing both trading volume and wallet activity on-chain to record highs. In just a few weeks, the number of active PEPE wallets jumped by over 500%, as retail traders piled in amid the euphoria.

However, once prices stabilized and began to retrace, many retail buyers who entered late suffered losses. On-chain data showed that over 40% of wallet addresses that bought near the top ended up in the red.

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Hype to Dump: The ELON & MONKE Cases

Following his PEPE success, Wynn continued to promote other memecoins, often acting as a public endorser on social media while secretly accumulating positions beforehand.

For example, he accumulated ELON tokens across multiple wallets and then began loudly promoting the project, praising its explosive potential. Attracted by his previous performance, retail investors followed suit. But as prices soared, on-chain data revealed Wynn gradually offloaded his holdings, triggering a 70% crash. This led to severe retail losses and sharp criticism from the community, accusing him of “pump-and-dump” tactics.

In contrast, his attempt to replicate this playbook with MONKE ended poorly. Despite taking early positions and promoting the token, the market response was tepid, and prices fell shortly after a brief rise. Even Wynn’s wallets recorded losses, leading some to question whether his influence was beginning to fade.

Whales Aren’t the Enemy—But Beware Structural Inequality

Whales like Wynn operate within the rules, using available tools like leverage and liquidity. But when combined with capital, information, and influence, their market power becomes disproportionate.

In traditional finance, institutions are bound by compliance and disclosure rules. But in DeFi, whales act anonymously and without accountability. Despite the transparent nature of the blockchain, these players can still manipulate markets with precision and minimal consequences.

Conclusion: After the Profit, Who Holds the Bag?

James Wynn’s rise wasn’t a fluke—he’s a byproduct of the structural dynamics of the crypto market, where the game of manipulation and being manipulated continues daily.

For everyday investors, the key lesson is to understand the rules of the game. Decentralization doesn’t guarantee fairness, but it does guarantee one thing: every pump-and-dump scheme leaves evidence on-chain.

The question is—can you read it?

Related:

Adam Back leads $2.2M raise for Swedish health firm’s Bitcoin buys

WLFI中文网

WLFI中文网